Legacy Planning

You do what is necessary to facilitate postmortem asset transfers to your heirs when you plan your estate. If you execute a basic but well-rounded plan, you will include a living will and durable powers of attorney to account for possible incapacity late in your life. For many, this will be sufficient, but it is possible to take the process to another level.Legacy planning is a more complete form of estate planning. There is no single framework, but there are a number of things that can be taken into consideration when you are putting a legacy plan in place. Once you understand your options, you can work with an attorney from our firm to custom craft the ideal legacy plan for you and your family.

Wealth Preservation

Estate taxes can take a heavy toll on the legacy that you intend to leave to your loved ones after you are gone. There is a federal estate tax that successful people have to be concerned about, and here in Illinois, we have a state level estate tax. The maximum rate of the federal estate tax is 40%, and the top rate for the state estate tax is 16% at the time of this writing.These taxes are only a factor for wealthy families because there are estate tax exclusions. The exclusion is the amount that you can transfer before the estate tax would be applied.

Right now, the federal estate tax exclusion is $11.4 million, and the state level exclusion is $4 million.It should be noted that the federal exclusion is updated annually to account for inflation, and the parameters of both taxes can be changed via legislative mandate. The figures quoted above are not permanently etched in stone, but they can definitely serve as guidelines.If your estate is going to be subject to taxation, there are steps that can be taken to mitigate the exposure. Grantor retained annuity trusts, generation-skipping trusts, charitable lead trusts, and qualified personal residence trusts are some of the devices that are used.

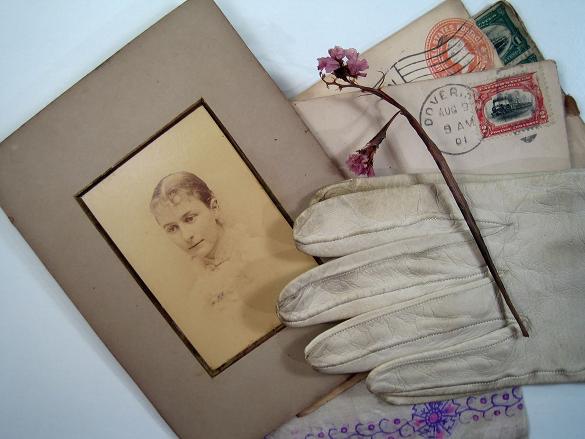

Family Heirlooms

Your legacy planning efforts can involve the careful evaluation of the family heirlooms that you have in your possession. Over the years, your respective family members may have commented on some of the items that have been passed down to you. Making sure that all of your heirlooms wind up in the right hands can be very meaningful for everyone concerned.

Ethical Will

The ethical will is a document that is not legally binding in any way, and it has nothing to do with money. In spite of this, it can be one of the most meaningful parts of your legacy plan. Ethical wills have been used since biblical times to pass along moral and spiritual guidance to the loved ones that you will be leaving behind.

Charitable Contributions

Charitable giving can be part of your legacy plan if you are in a position to give something back to causes and institutions that are meaningful to you. Some people will establish private family foundations, and the vast majority of them are funded with less than $10 million. This is one way to help others while you leave a lasting legacy of generosity.Other options exist if you are interested in giving to charity. Donor advised funds are quite popular because of the streamlined accounting. You make a single contribution to the fund, and you can advise it with regard to the different charities that you would like to support.In addition to the personal rewards that go along with acts of selflessness, there are tax advantages to be realized if you make charitable giving part of your legacy plan.

Learn More About Legacy Planning

These are some of the components that can be included within your legacy plan, but there are other possibilities. Without question, when you consciously craft your legacy, you will always be remembered in a positive light. If you would like to take the first step, we would be more than glad to help. We offer free, no obligation consultations, and we can explain everything to you in more detail if you take advantage of the opportunity. You can give us a call right now at (312) 753-6000 to set up an appointment.